In the last two months, a rapid rise in copper prices is widely seen, from (LME) US$8,000 in February to more than US$10,000 (LME) yesterday (April 30). The magnitude and speed of this increase were beyond our expectation. Such increase has caused many of our orders and contracts much pressure brought by surging copper price. The reason is that some quotations were offered in February, but customers’ orders was only placed in April. Under such circumstances, we still inform our customers to rest assured that Tianjin Ruiyuan Electric Material Co., Ltd.(TRY) is one highly committed and responsible enterprise and no matter how much copper price climbs up, we will abide by the agreement and deliver goods on time.

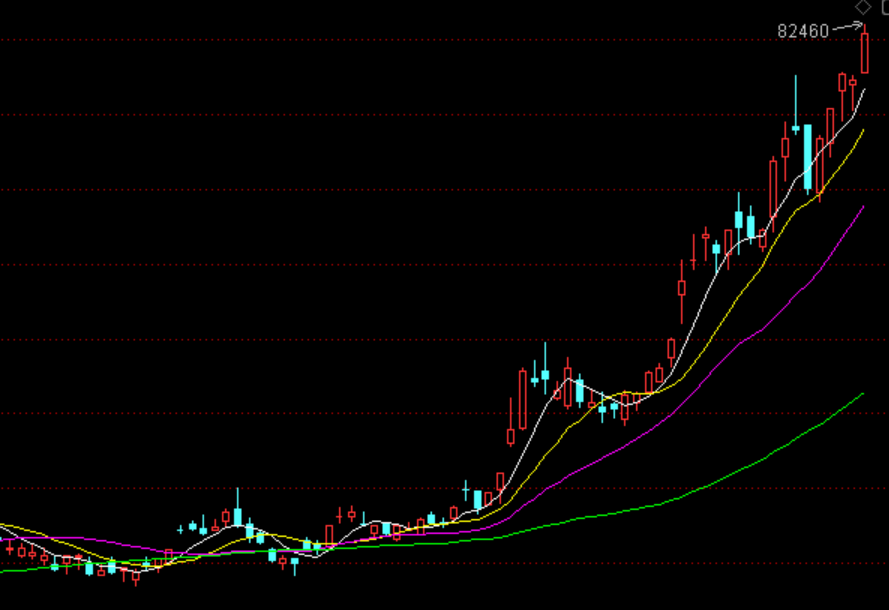

By our analysis, it’ s speculated that copper price will keep high for some time and can be very likely to hit new record. Facing a global copper shortage and strong demands, London Metal Exchange (LME) copper futures have continued to skyrocket as a whole, returning to the US$10,000 per ton mark after two years. On April 29, LME copper futures rose 1.7% to US$10,135.50 per ton, close to the record high of US$10,845 set in March 2022. BHP Billiton’s takeover bid for Anglo American plc also highlighted supply concerns, which became an important catalyst for copper prices to exceed US$10,000/ton. At present, BHP Billiton’s copper mine production capacity cannot keep up with market demand. Expanding its own copper production capacity through acquisitions might be the fastest way to meet market demands, especially in the context of the current tight global copper supply.

There are also several other factors resulting in the rise. First, regional conflicts are still ongoing. Conflict parties consume a large amount of ammunition every day, while copper is one of the important metals for manufacturing ammunition. Constant conflicts in the Middle East, and military industry factors are one of the most vital and direct reason for skyrocketing copper price.

In addition, the development of AI also has a long-term impact on copper price. It requires the support of strong computing power which relies on big data centers and development in infrastructure construction in which electric power infrastructure equipment plays a big role while copper is one important metal for electric power infrastructure and can influence AI development in depth too. It can be said that infrastructure construction is a key link in liberating computing power and promoting the development of AI.

Besides, problem of under investment makes it harder to find high-quality mines. Small exploration companies owning less capital also faces pressure from social and environmental protection while the costs of labor, equipment and raw materials have soared. Therefore, copper prices must become high to stimulate the construction of new mines. Olivia Markham, fund manager at BlackRock told that copper prices must exceed $12,000 to motivate copper miners to invest in the development of new mines. It’ s highly possible that the above-mentioned and other factors will lead to a further rise in copper price.

Post time: May-02-2024